|

251 Valentine Lane, Yonkers, NY, 10705 | $1,350,000

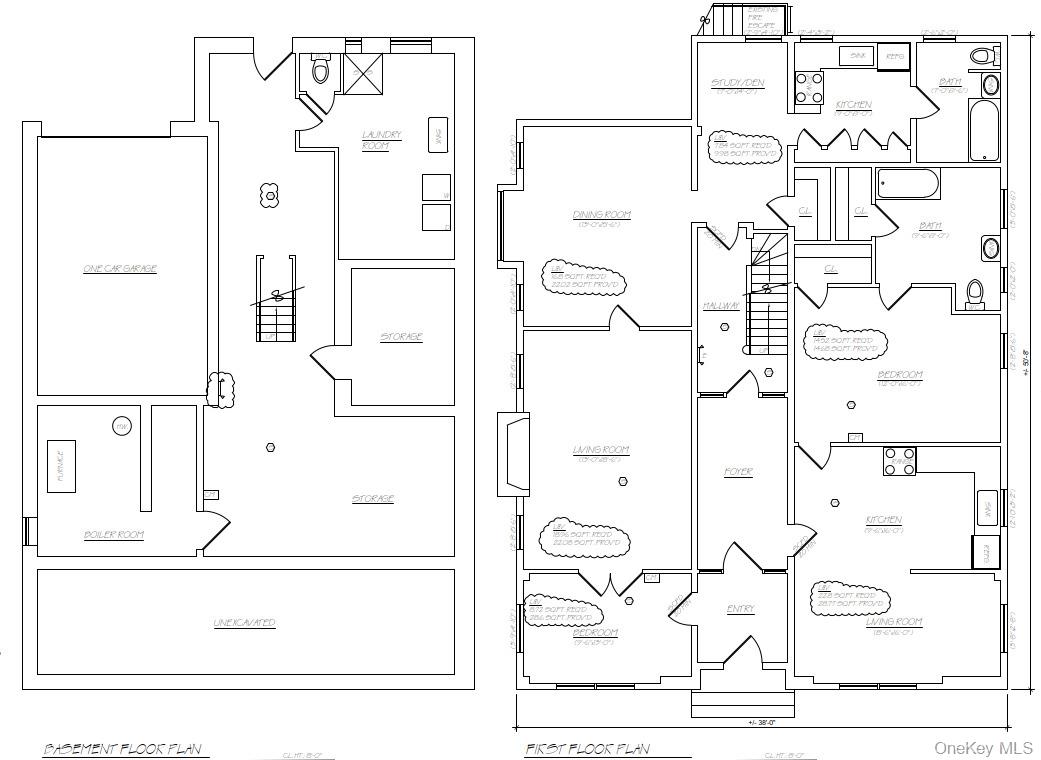

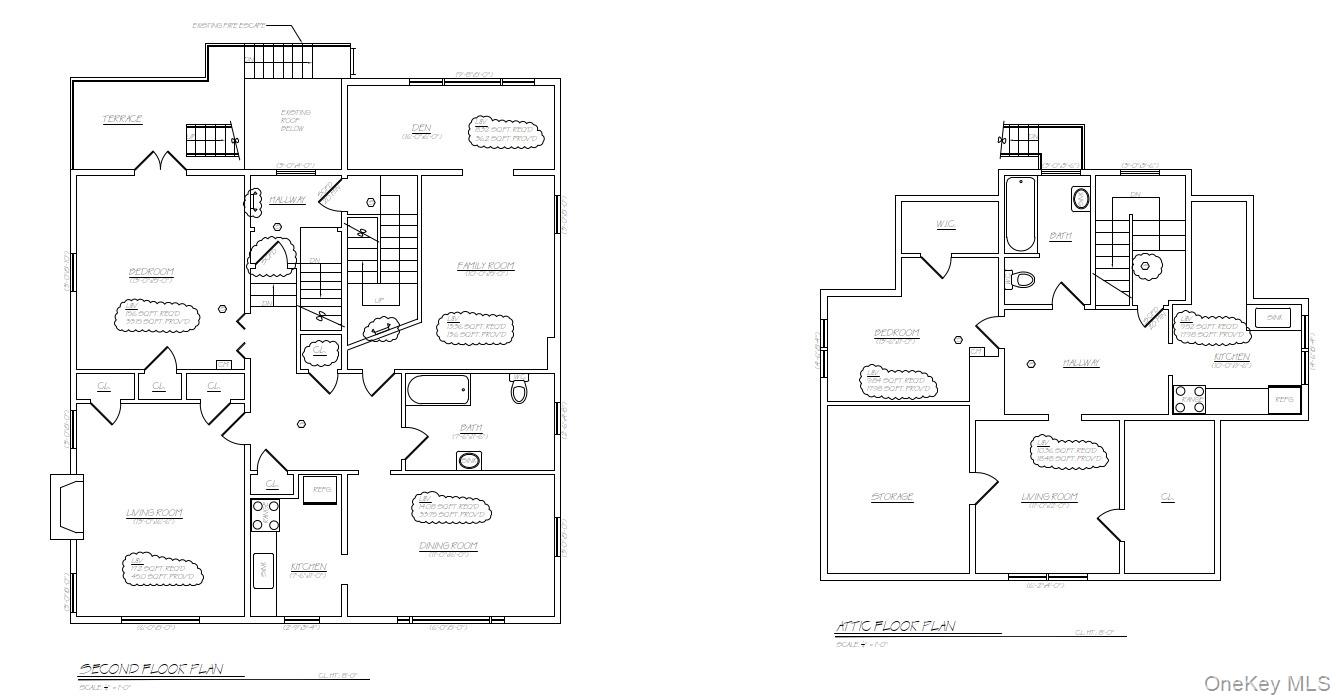

251 Valentine Lane presents a compelling opportunity to acquire a 4-family multifamily investment property in a centrally located Yonkers neighborhood supported by consistent rental demand and long-term appreciation fundamentals. This asset is well suited for buy-and-hold investors, portfolio expansion, 1031 exchange buyers, or owner-occupant investors seeking durable income in Westchester County. The property consists of four income-producing residential units, offering diversified rental streams that help reduce vacancy exposure and enhance income stability compared to smaller residential investments. Multifamily properties of this size remain highly attractive due to operational efficiencies, favorable financing options, and their proven ability to perform across varying market cycles. A key value driver is off-street parking, a premium amenity in Yonkers that continues to support strong tenant demand and long-term retention. In urban and near-urban rental markets, parking availability remains a meaningful differentiator that can improve leasing velocity, reduce turnover, and support higher effective rents over time. The property’s central Yonkers location provides convenient access to major roadways, public transportation, employment centers, retail corridors, and essential services. This accessibility supports a broad and stable tenant base. Yonkers continues to benefit from its proximity to New York City while offering relative affordability within Westchester County, contributing to sustained rental demand and long-term investment appeal. From an investment perspective, 251 Valentine Lane offers multiple strategic pathways. Investors may pursue a traditional buy-and-hold strategy, capturing steady rental income while benefiting from appreciation in a supply-constrained market. The asset may also present value-add potential through selective unit improvements, operational efficiencies, or rent optimization over time, subject to existing leases and property condition. Importantly, the 4-unit configuration also makes this property highly attractive to owner-occupant investors. Buyers have the opportunity to reside in one unit while generating rental income from the remaining apartments, effectively offsetting housing costs while building equity. This strategy continues to be popular among investors seeking both lifestyle flexibility and long-term wealth creation. The ability to appeal to owner-occupants also enhances future marketability and liquidity upon resale. Westchester County multifamily assets remain in high demand among both local and out-of-area investors due to limited inventory, stable tenant demand, and historically strong market performance. Yonkers, in particular, continues to draw interest as a gateway market offering accessibility, scale, and long-term growth potential.

Features

- Amenities: Park

- Bedrooms: 6

- Baths: 4 full

- Style: Colonial

- Year Built: 1900

- Garage: 1-car

- Heating: Natural Gas, Radiant

- Cooling: None

- Basement: Full

- Acreage: 0.18

- Est. Taxes: $20,003

- Elem. School: Yonkers Early Childhood Academy

- Middle School: Yonkers Middle School

- High School: Yonkers High School

- School District: Yonkers

- MLS#: 949827

- Days on Market: 1 day

- Website: https://www.raveis.com

/eprop/949827/251valentinelane_yonkers_ny?source=qrflyer

William Raveis Family of Services

Our family of companies partner in delivering quality services in a one-stop-shopping environment. Together, we integrate the most comprehensive real estate, mortgage and insurance services available to fulfill your specific real estate needs.

Customer Service

888.699.8876

Contact@raveis.com

Our family of companies offer our clients a new level of full-service real estate. We shall:

- Market your home to realize a quick sale at the best possible price

- Place up to 20+ photos of your home on our website, raveis.com

- Provide frequent communication and tracking reports showing the Internet views your home received on raveis.com

- Showcase your home on raveis.com with a larger and more prominent format

- Give you the full resources and strength of William Raveis Real Estate, Mortgage & Insurance and our cutting-edge technology

To learn more about our credentials, visit raveis.com today.

Frank KolbSenior Vice President - Coaching & Strategic, William Raveis Mortgage, LLC

NMLS Mortgage Loan Originator ID 81725

203.980.8025

Frank.Kolb@raveis.com

Our Executive Mortgage Banker:

- Is available to meet with you in our office, your home or office, evenings or weekends

- Offers you pre-approval in minutes!

- Provides a guaranteed closing date that meets your needs

- Has access to hundreds of loan programs, all at competitive rates

- Is in constant contact with a full processing, underwriting, and closing staff to ensure an efficient transaction

Ryan FortierInsurance Sales Director, William Raveis Insurance

516.739.7731

Ryan.Fortier@raveis.com

Our Insurance Division:

- Will Provide a home insurance quote within 24 hours

- Offers full-service coverage such as Homeowner's, Auto, Life, Renter's, Flood and Valuable Items

- Partners with major insurance companies including Chubb, Kemper Unitrin, The Hartford, Progressive,

Encompass, Travelers, Fireman's Fund, Middleoak Mutual, One Beacon and American Reliable

251 Valentine Lane, Yonkers, NY, 10705

$1,350,000

Customer Service

William Raveis Real Estate

Phone: 888.699.8876

Contact@raveis.com

Frank Kolb

Senior Vice President - Coaching & Strategic

William Raveis Mortgage, LLC

Phone: 203.980.8025

Frank.Kolb@raveis.com

NMLS Mortgage Loan Originator ID 81725

|

5/6 (30 Yr) Adjustable Rate Jumbo* |

30 Year Fixed-Rate Jumbo |

15 Year Fixed-Rate Jumbo |

|

|---|---|---|---|

| Loan Amount | $1,080,000 | $1,080,000 | $1,080,000 |

| Term | 360 months | 360 months | 180 months |

| Initial Interest Rate** | 5.125% | 5.875% | 5.750% |

| Interest Rate based on Index + Margin | 8.125% | ||

| Annual Percentage Rate | 6.021% | 6.007% | 5.932% |

| Monthly Tax Payment | $1,667 | $1,667 | $1,667 |

| H/O Insurance Payment | $125 | $125 | $125 |

| Initial Principal & Interest Pmt | $5,880 | $6,389 | $8,968 |

| Total Monthly Payment | $7,672 | $8,181 | $10,760 |

* The Initial Interest Rate and Initial Principal & Interest Payment are fixed for the first and adjust every six months thereafter for the remainder of the loan term. The Interest Rate and annual percentage rate may increase after consummation. The Index for this product is the SOFR. The margin for this adjustable rate mortgage may vary with your unique credit history, and terms of your loan.

** Mortgage Rates are subject to change, loan amount and product restrictions and may not be available for your specific transaction at commitment or closing. Rates, and the margin for adjustable rate mortgages [if applicable], are subject to change without prior notice.

The rates and Annual Percentage Rate (APR) cited above may be only samples for the purpose of calculating payments and are based upon the following assumptions: minimum credit score of 740, 20% down payment (e.g. $20,000 down on a $100,000 purchase price), $1,950 in finance charges, and 30 days prepaid interest, 1 point, 30 day rate lock. The rates and APR will vary depending upon your unique credit history and the terms of your loan, e.g. the actual down payment percentages, points and fees for your transaction. Property taxes and homeowner's insurance are estimates and subject to change.