|

Presented by

Megan Northrop |

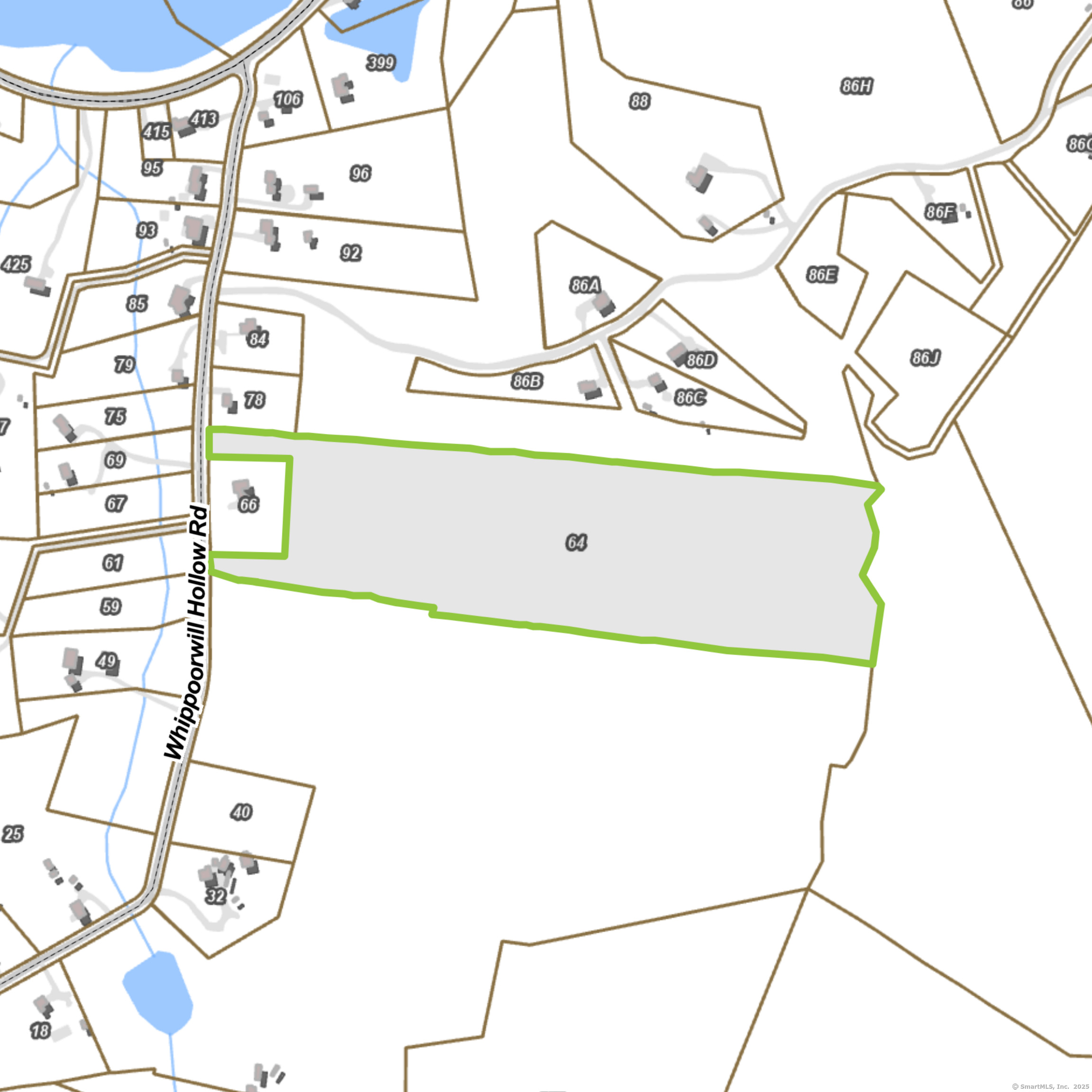

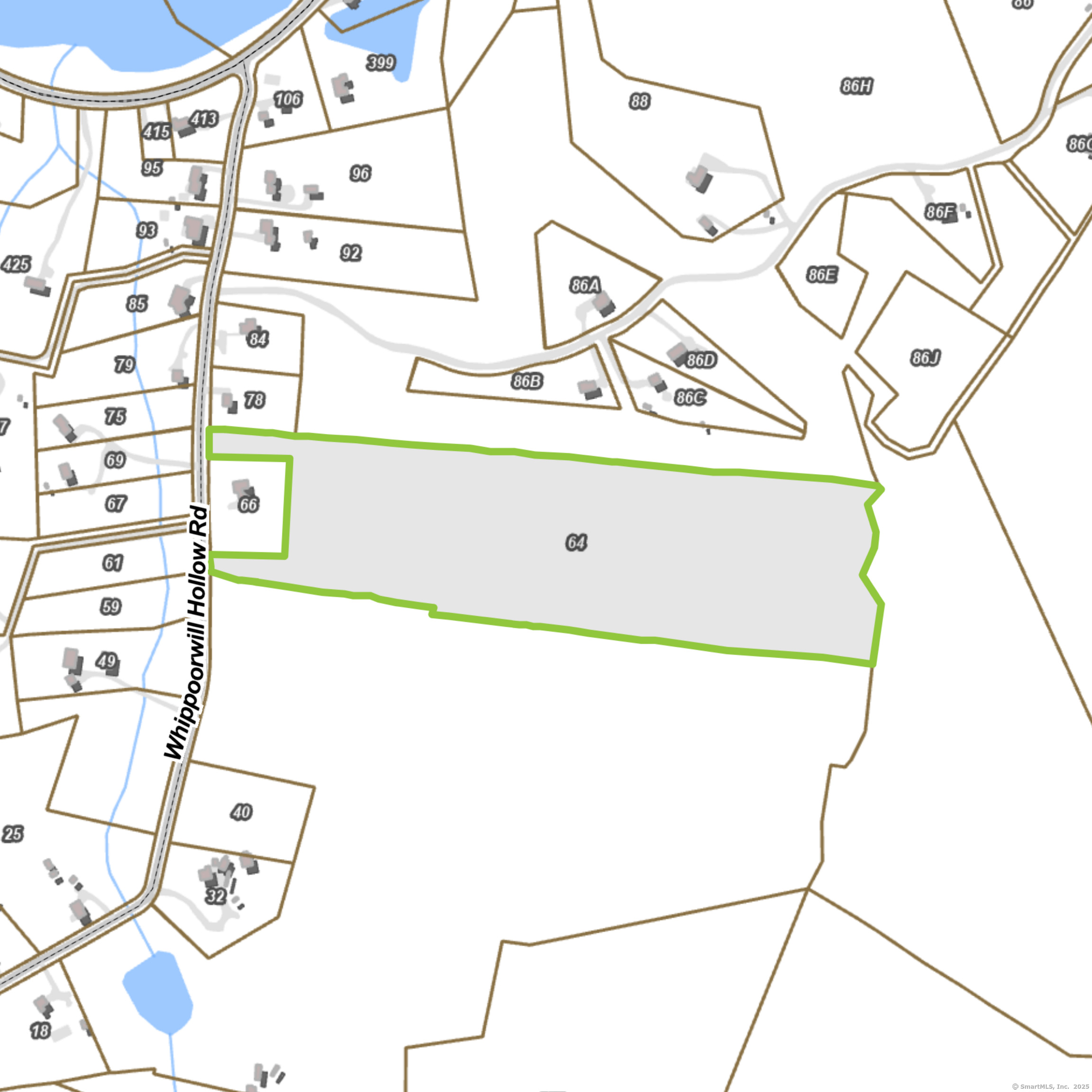

64 Whippoorwill Road, Franklin, CT, 06254 | $550,000

Farm, Luxury Home or Possibly Affordable Housing. Rare 27. 47-Acre Estate or Development Parcel in Franklin's Countryside This expansive 27. 47-acre tract on Whipporwill Hollow Road offers a unique blend of privacy, scale and flexibility - ideal for a luxury estate build or as a development site with potential for affordable housing. Property Highlights Generous acreage - With nearly 28 contiguous acres, this parcel stands out in a region where large tracts are increasingly scarce. Estate potential - For the buyer seeking a bespoke home, this site offers space for a main residence, guest house or pool, expansive lawns or meadows, wooded buffer zones and sweeping rural views. Affordable-housing/leverage potential - Given the near-term market dynamics and local policy context (see below), the land may also support a development scheme incorporating deed-restricted affordable units or mixed-income housing, subject to zoning, approvals and infrastructure. Quiet accessibility - Whipporwill Hollow Road offers the tranquility of rural Connecticut with reasonable access to nearby amenities. Natural setting & lifestyle appeal - Mature trees, open clearings and the serene setting combine to create a country lifestyle with room to roam, garden, ride, hike or simply retreat. Local Context - Affordable Housing Ratio According to the Town of Franklin's most recent Plan of Conservation & Development (effective November 1, 2023), the affordable housing inventory - measured under Connecticut General Statute 830g (which counts certain deed-restricted, income-qualified units) - is approximately 5. 97% of the town's housing stock. Because Franklin has not yet reached the 10 % threshold, it remains subject to the appeals provisions of 8-30g; local policy guidance even recommends that future larger residential development proposals include at least 10 % of units as affordable. Franklin CT In broader reporting, Franklin was noted with an approximate 3. 9 % affordable rate in earlier years - reflecting recent incremental increases. Why This Matters For an estate buyer: The low percentage of affordable housing in town reinforces the rarity of development opportunities like this, and the land's scale gives significant flexibility in layout, design and landscaping. For a developer or investor targeting affordable/mixed-income: The town's sub-10 % ratio means this community remains eligible for the 8-30g "safe harbor" appeals path - meaning proposals with deed-restricted affordable units may have an easier path under state law. For a hybrid or long-term investor: The property's size and rural character allow for phasing-start with an estate build and later subdivide or develop part of the parcel for affordable or workforce housing when market and approvals align. Use-Case Ideas Luxury Estate: Nestle a signature home and outbuildings among woodlands and meadows, with private drive, pond or pool, and expansive grounds for recreation or equestrian use. Estate + Guest/Staff Wing: Create a multi-structure compound - main house, guest cottage or caretaker's unit, barn or studio space - leaving the remainder of the acreage as preserved natural lands or future build-sites. Affordable Housing/Mixed-Income Project: Partner with a housing nonprofit or developer to craft a plan where a portion of the acreage is subdivided for smaller-scale residential units, workforce cottages or multifamily units with deed-restricted affordable homes, while the rest remains open or residential. Combination Strategy: Build the estate now and hold a portion of the acreage for future development

Features

- Zoning: R080

- Frontage: Municipal Street

- Lot Desc: Lightly Wooded,Level Lot,Cleared

- Elem. School: Per Board of Ed

- High School: Per Board of Ed

- MLS#: 24138379

- Website: https://www.raveis.com

/prop/24138379/64whippoorwillroad_franklin_ct?source=qrflyer

William Raveis Family of Services

Our family of companies partner in delivering quality services in a one-stop-shopping environment. Together, we integrate the most comprehensive real estate, mortgage and insurance services available to fulfill your specific real estate needs.

Megan NorthropSales Associate

203.671.3311

Megan.Northrop@Raveis.com

Our family of companies offer our clients a new level of full-service real estate. We shall:

- Market your home to realize a quick sale at the best possible price

- Place up to 20+ photos of your home on our website, raveis.com

- Provide frequent communication and tracking reports showing the Internet views your home received on raveis.com

- Showcase your home on raveis.com with a larger and more prominent format

- Give you the full resources and strength of William Raveis Real Estate, Mortgage & Insurance and our cutting-edge technology

To learn more about our credentials, visit raveis.com today.

Gerry O'BrianVP, Mortgage Banker, William Raveis Mortgage, LLC

NMLS Mortgage Loan Originator ID 223191

203.274.0501

Gerry.OBrian@raveis.com

Our Executive Mortgage Banker:

- Is available to meet with you in our office, your home or office, evenings or weekends

- Offers you pre-approval in minutes!

- Provides a guaranteed closing date that meets your needs

- Has access to hundreds of loan programs, all at competitive rates

- Is in constant contact with a full processing, underwriting, and closing staff to ensure an efficient transaction

Alex FerroInsurance Sales Director, William Raveis Insurance

203.610.1536

Alex.Ferro@raveis.com

Our Insurance Division:

- Will Provide a home insurance quote within 24 hours

- Offers full-service coverage such as Homeowner's, Auto, Life, Renter's, Flood and Valuable Items

- Partners with major insurance companies including Chubb, Kemper Unitrin, The Hartford, Progressive,

Encompass, Travelers, Fireman's Fund, Middleoak Mutual, One Beacon and American Reliable

Ray CashenPresident, William Raveis Attorney Network

203.925.4590

For homebuyers and sellers, our Attorney Network:

- Consult on purchase/sale and financing issues, reviews and prepares the sale agreement, fulfills lender

requirements, sets up escrows and title insurance, coordinates closing documents - Offers one-stop shopping; to satisfy closing, title, and insurance needs in a single consolidated experience

- Offers access to experienced closing attorneys at competitive rates

- Streamlines the process as a direct result of the established synergies among the William Raveis Family of Companies

64 Whippoorwill Road, Franklin, CT, 06254

$550,000

Megan Northrop

Sales Associate

William Raveis Real Estate

Phone: 203.671.3311

Megan.Northrop@Raveis.com

Gerry O'Brian

VP, Mortgage Banker

William Raveis Mortgage, LLC

Phone: 203.274.0501

Gerry.OBrian@raveis.com

NMLS Mortgage Loan Originator ID 223191

|

5/6 (30 Yr) Adjustable Rate Conforming* |

30 Year Fixed-Rate Conforming |

15 Year Fixed-Rate Conforming |

|

|---|---|---|---|

| Loan Amount | $440,000 | $440,000 | $440,000 |

| Term | 360 months | 360 months | 180 months |

| Initial Interest Rate** | 5.375% | 5.990% | 5.250% |

| Interest Rate based on Index + Margin | 8.125% | ||

| Annual Percentage Rate | 6.161% | 6.132% | 5.522% |

| Monthly Tax Payment | N/A | N/A | N/A |

| H/O Insurance Payment | $92 | $92 | $92 |

| Initial Principal & Interest Pmt | $2,464 | $2,635 | $3,537 |

| Total Monthly Payment | $2,556 | $2,727 | $3,629 |

* The Initial Interest Rate and Initial Principal & Interest Payment are fixed for the first and adjust every six months thereafter for the remainder of the loan term. The Interest Rate and annual percentage rate may increase after consummation. The Index for this product is the SOFR. The margin for this adjustable rate mortgage may vary with your unique credit history, and terms of your loan.

** Mortgage Rates are subject to change, loan amount and product restrictions and may not be available for your specific transaction at commitment or closing. Rates, and the margin for adjustable rate mortgages [if applicable], are subject to change without prior notice.

The rates and Annual Percentage Rate (APR) cited above may be only samples for the purpose of calculating payments and are based upon the following assumptions: minimum credit score of 740, 20% down payment (e.g. $20,000 down on a $100,000 purchase price), $1,950 in finance charges, and 30 days prepaid interest, 1 point, 30 day rate lock. The rates and APR will vary depending upon your unique credit history and the terms of your loan, e.g. the actual down payment percentages, points and fees for your transaction. Property taxes and homeowner's insurance are estimates and subject to change.