|

248 East 3rd Street, #3B, New York (E. Greenwich Village), NY, 10009 | $430,000

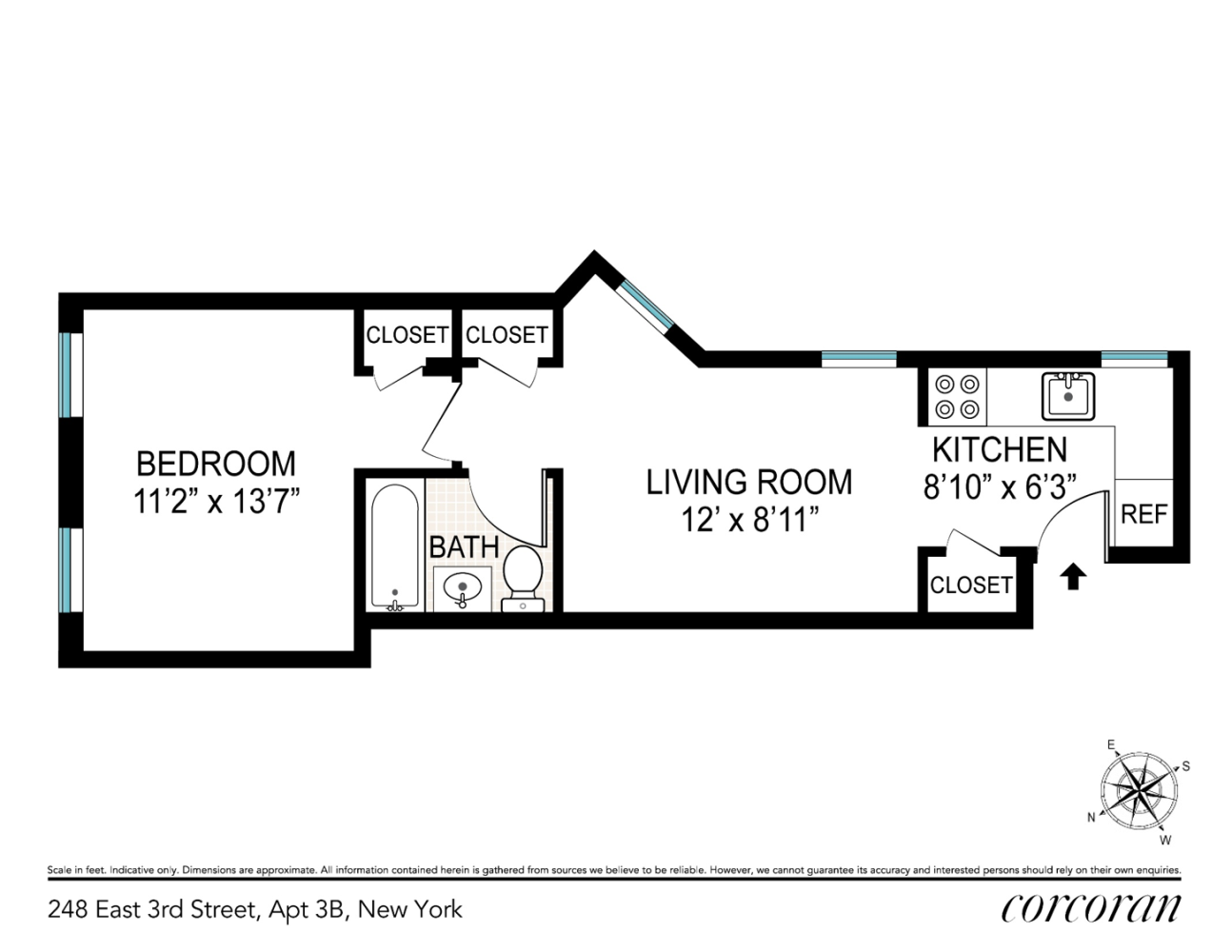

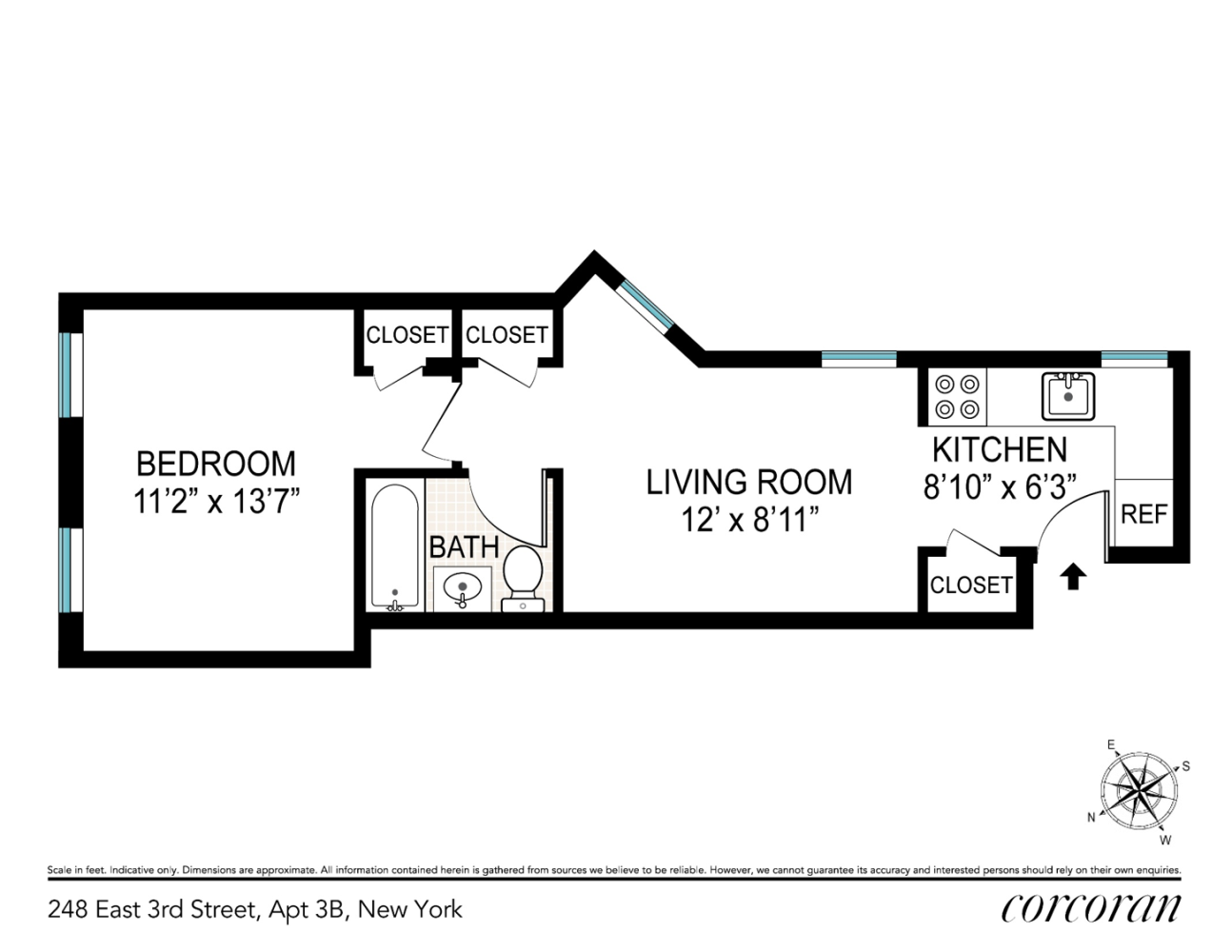

Now available in a classic East Village ELEVATOR building! This sun-filled 1-bedroom, 1-bathroom home offers incredible natural light with exposures to the north, east, and south. A generously sized bedroom easily fits a queen-sized furniture set, while the windowed kitchen adds a welcoming, airy feel to your daily routine. Hardwood floors run throughout, and thoughtful closet space ensures everything has its place. A smart layout and classic features make this home as functional as it is inviting.

Set in a well-maintained, pet-friendly HDFC Coop, this boutique elevator building with voice intercom system combines comfort and community. Ideal for those looking for a more personal, connected living experience in one of Manhattan's highly sought-out neighborhoods. This Coop has income restrictions as follows: 120% AMI (1 Person Household: $136, 080; 2 Person Household: $155, 520). Primary Residents only, and CASH ONLY offers considered.

Live just moments from everything that makes Downtown so magnetic, from hip cafes and restaurants to amazing night life. Located near the 2nd Avenue F train and the Bowery J/Z stations, Whole Foods, Tompkins Square Park (complete with a beloved dog run!), and the East River Park, this home puts the best of the East Village right outside your door. Whether you're grabbing brunch, biking along the waterfront, or catching a show, this location offers something for everyone. Contact us today to view this AMAZING home-ownership opportunity!

Features

- Town: New York

- Cooling: Unknown Type

- Levels: 6

- Rooms: 3

- Bedrooms: 1

- Baths: 1 full

- Laundry: None

- Year Built: 1954

- Pet Policy: Pets Allowed

- Building Access : Elevator

- Service Level: Video Intercom

- OLR#: RLS20028761

- Days on Market: 223 days

- Website: https://www.raveis.com

/prop/RLS20028761/248east3rdstreet_newyork_ny?source=qrflyer

All information is intended only for the Registrant’s personal, non-commercial use. This information is not verified for authenticity or accuracy and is not guaranteed and may not reflect all real estate activity in the market. RLS Data display by William Raveis Real Estate, Inc.

All information is intended only for the Registrant’s personal, non-commercial use. This information is not verified for authenticity or accuracy and is not guaranteed and may not reflect all real estate activity in the market. RLS Data display by William Raveis Real Estate, Inc.Listing courtesy of Corcoran Group

William Raveis Family of Services

Our family of companies partner in delivering quality services in a one-stop-shopping environment. Together, we integrate the most comprehensive real estate, mortgage and insurance services available to fulfill your specific real estate needs.

Customer Service

888.699.8876

Contact@raveis.com

Our family of companies offer our clients a new level of full-service real estate. We shall:

- Market your home to realize a quick sale at the best possible price

- Place up to 20+ photos of your home on our website, raveis.com

- Provide frequent communication and tracking reports showing the Internet views your home received on raveis.com

- Showcase your home on raveis.com with a larger and more prominent format

- Give you the full resources and strength of William Raveis Real Estate, Mortgage & Insurance and our cutting-edge technology

To learn more about our credentials, visit raveis.com today.

Sarah DeFlorioVP, Mortgage Banker, William Raveis Mortgage, LLC

NMLS Mortgage Loan Originator ID 1880936

347.223.0992

Sarah.DeFlorio@Raveis.com

Our Executive Mortgage Banker:

- Is available to meet with you in our office, your home or office, evenings or weekends

- Offers you pre-approval in minutes!

- Provides a guaranteed closing date that meets your needs

- Has access to hundreds of loan programs, all at competitive rates

- Is in constant contact with a full processing, underwriting, and closing staff to ensure an efficient transaction

Ryan FortierInsurance Sales Director, William Raveis Insurance

516.739.7731

Ryan.Fortier@raveis.com

Our Insurance Division:

- Will Provide a home insurance quote within 24 hours

- Offers full-service coverage such as Homeowner's, Auto, Life, Renter's, Flood and Valuable Items

- Partners with major insurance companies including Chubb, Kemper Unitrin, The Hartford, Progressive,

Encompass, Travelers, Fireman's Fund, Middleoak Mutual, One Beacon and American Reliable

248 East 3rd Street, #3B, New York (E. Greenwich Village), NY, 10009

$430,000

Customer Service

William Raveis Real Estate

Phone: 888.699.8876

Contact@raveis.com

Sarah DeFlorio

VP, Mortgage Banker

William Raveis Mortgage, LLC

Phone: 347.223.0992

Sarah.DeFlorio@Raveis.com

NMLS Mortgage Loan Originator ID 1880936

|

5/6 (30 Yr) Adjustable Rate Conforming* |

30 Year Fixed-Rate Conforming |

15 Year Fixed-Rate Conforming |

|

|---|---|---|---|

| Loan Amount | $344,000 | $344,000 | $344,000 |

| Term | 360 months | 360 months | 180 months |

| Initial Interest Rate** | 5.625% | 5.990% | 5.125% |

| Interest Rate based on Index + Margin | 8.125% | ||

| Annual Percentage Rate | 6.322% | 6.156% | 5.415% |

| Monthly Tax Payment | N/A | N/A | N/A |

| H/O Insurance Payment | $75 | $75 | $75 |

| Initial Principal & Interest Pmt | $1,980 | $2,060 | $2,743 |

| Total Monthly Payment | $2,055 | $2,135 | $2,818 |

* The Initial Interest Rate and Initial Principal & Interest Payment are fixed for the first and adjust every six months thereafter for the remainder of the loan term. The Interest Rate and annual percentage rate may increase after consummation. The Index for this product is the SOFR. The margin for this adjustable rate mortgage may vary with your unique credit history, and terms of your loan.

** Mortgage Rates are subject to change, loan amount and product restrictions and may not be available for your specific transaction at commitment or closing. Rates, and the margin for adjustable rate mortgages [if applicable], are subject to change without prior notice.

The rates and Annual Percentage Rate (APR) cited above may be only samples for the purpose of calculating payments and are based upon the following assumptions: minimum credit score of 740, 20% down payment (e.g. $20,000 down on a $100,000 purchase price), $1,950 in finance charges, and 30 days prepaid interest, 1 point, 30 day rate lock. The rates and APR will vary depending upon your unique credit history and the terms of your loan, e.g. the actual down payment percentages, points and fees for your transaction. Property taxes and homeowner's insurance are estimates and subject to change.